#11: Next Year Planning Starts Today

Numbers behind the delivery. My world of financial planning and budgeting: a place where spreadsheets have a life of their own.

A classic example of poor planning is the cover of today's newsletter. I neglected to account for my designer Valeria's vacation in our schedule, and here we are…

Jokes aside, as the new year approaches and many are wrapping up their planning, I want to dedicate this newsletter to the crucial topics of planning and budgeting.

From my perspective, we plan and budget everything at least a year in advance. This isn't to slow us down, but rather to streamline everything.

Responsibility for making any decision is a challenging area for any manager. One grapples with thoughts like, "What if I make the wrong decision?".

It's vital that managers aren't preoccupied with concerns over basic decisions, such as whether they can purchase a new tool or if there's a budget for hiring a new SDR.

In my view, only decentralized companies, where each manager has the autonomy to make their own decisions, work according to financial planning and budgeting, can grow effectively.

Today, I’ll share my thoughts and experiences on two key areas:

Financial planning

Budgeting

Financial Planning

When considering working on it, focus on these three core metrics:

Existing clients or retention

New clients or new sales

Churned clients / churned money

These can be measured in numbers or currencies, such as having 1 client, or making $10,000/mo. For today's discussion, I’ll use MRR and monthly subscriptions, also known as retainers, as examples for my calculations.

Financial planning involves evaluating achievable monthly growth, factoring in new sales and churn.

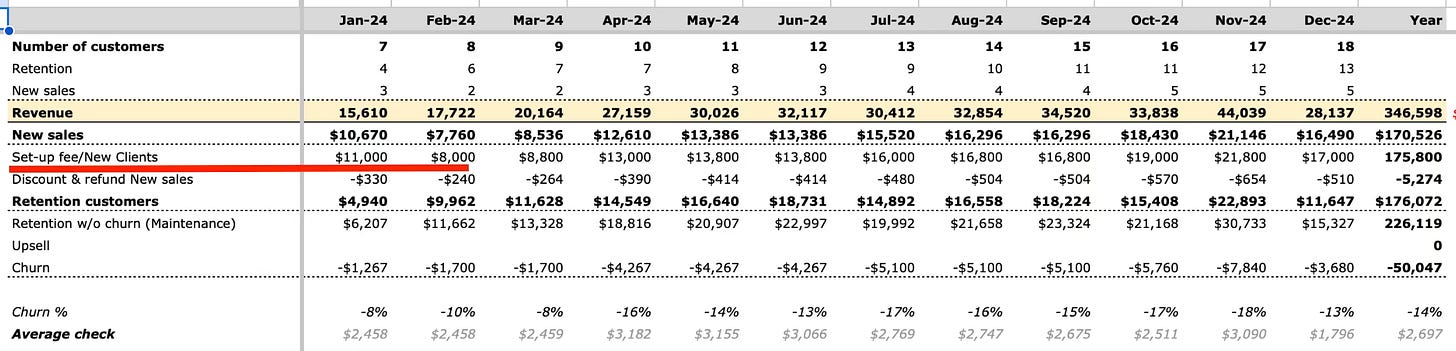

Refer to the image below: I acquire 1 new client in January, then each month, I gain an additional client. I then progressively increase this number, X. I don't lose any clients to churn initially, as my minimum contract duration is 6 months. Then, starting from month-7, I might experience a churn rate of 5%-10% of clients. This method appears simple with up to 10 clients, but as you scale up to 100 or 200 clients, it becomes both fun and insightful.

With this framework, you can change revenue to project-based (one-time payment) instead of monthly retainers. This allows for planning that shows more income in the first month, without retainers. See the image below.

Such an exercise can help you:

Understand and plan the actual real growth you can achieve in terms of new sales each month.

Determine how many clients or how much revenue you lose monthly due to churn.

Drill down further in your cost versus profit calculations.

Now, once you've mastered your basic metrics, you can delve into more complex but engaging aspects:

COS (Cost of Service): This encompasses people, tools, and all expenses involved in servicing your clients and retaining them.

This image illustrates your revenue planning alongside your COS planning. In this example, as an agency providing copywriting services, I require a writer, a designer, and some tools to deliver value to my clients.

Note: Before inputting these numbers into my sheet, I performed other calculations to determine:

The average number of clients a copywriter and designer can manage.

Their average salaries.

Now, I can easily calculate what percentage of my revenue (new, existing, or total) will be used to service my clients and when I need to hire more staff.

This also allows me to benchmark my cost of service and then engage in another exercise - budgeting for my team.

Your industry may dictate a COS as low as 20% or as high as 60%; it is different for everyone. I spoke more on this in one of the previous newsletters, if you want to refresh it.

At Belkins, we strive to keep COS as low as possible to free up financial resources for other initiatives. However, the challenge lies in finding a balance between:

Keeping COS as low as possible without sacrificing service quality.

Maintaining the highest quality of service achievable with a lower COS.

Ensuring growth levels that don’t increase your COS or diminish your service quality.

Marketing and Sales Cost: This includes people, tools, paid channels, and everything spent to acquire clients, essentially your Customer Acquisition Cost (CAC).

Again, this is a straightforward metric. It shows how much you spend to acquire a client. We typically plan this from the total revenue of a given month, always mindful that marketing spend in January will yield returns in 3 to 6 months, depending on where the funds are allocated.

Finally, adding COS + CAC likely consumes a substantial portion of your revenue.

What remains is then distributed equally across:

Operating Expenses (costs not directly related to servicing clients but essential for running your operation):

Bad Debts (clients who refused to pay)

Bank Charges and Fees

Administration (management, plus other related to operation roles)

Legal and Professional Fees

Rent and Utility

Office Expenses

Teambuilding & Education

Recruitment & HR

And, of course:

Other Expenses (such as hardware or miscellaneous spending, etc)

This leads to the Net Profit Before Taxes. Then, after accounting for Taxes, you arrive at the Net Profit After Taxes.

I don’t have specific metrics for your operating expenses, but I can confidently share more about other expenses:

If you're on a growth trajectory and aim to scale, be prepared to invest in marketing, possibly 10% to 20% of your revenue.

Sales expenses might range from 5% to 10% of your revenue. This is less than marketing because sales are usually a short-term investment (e.g., you close a deal → you pay a commission), whereas marketing has a longer-term payoff (e.g., you develop a blog post → you see ROI in 12 months).

If your CAC is high, then your COS should be low, and vice versa; you can't have high costs in both areas.

If your COS is high (50%-60% of revenue) because of an onshore delivery team (US-based team, for instance), then your focus should be on generating revenue from referrals and stable growth, ensuring excellent delivery and minimizing churn. In this scenario, you can't afford high client acquisition costs.

Conversely, if your COS is up to 30%-40%, you have that 10%-20% margin to invest in aggressive marketing. This might mean higher churn and more growth, potentially at the expense of lower margins. Managing all metrics during growth can be challenging, as operational and other expenses tend to rise uncontrollably. But growth is still growth, and the finer details can often be figured out later.

Speaking about profits, a 10% to 20% profit margin for agencies is a good benchmark. At the scale of $10M+, your profit percentage may decrease due to R&D, investments, mergers, etc. At the same time, I haven’t met any agency owner with $10M-$20M+ revenue who simply pockets $2M-$4M annually; often, they might earn even less cash. At this scale, the focus shifts from cash to the assets you are building.

I believe I have an excellent growth trajectory that combines rapid, healthy growth with consistency:

Year 1 - Up to $250k gross

Year 2 - Up to $1m gross (400% growth)

Year 3 - Up to $2.5m-$3m gross (250%-300% growth)

Year 4 - Up to $4.5m-$5m gross (80%-100% growth)

Year 5 - Up to $8m gross (60%-80% growth)

Year 6 - Up to $10m gross (25% growth)

Year 7 - Up to $13m-$14m gross (30%-40% growth)

Year 8 - Up to $15m gross (15%-20% growth)

Year 9 - Up to $17m gross (13%-15% growth)

Year 10 - Up to $20m gross (15%-20% growth)

Of course, these figures might vary from year to year, but you get the general idea, right?

Initially, you need rapid growth, at least 200%-300% YoY.

Then, in phase 2, growth rates decrease. However, during years 5 and 7, when you have fewer than 200 employees (before you undergo mid-size transformation) or after 300 employees (after you have completed this transformation), aim for 40%-50% growth, as you are the strongest in these years.

In phase 3, aim for comfortable growth of 15%-20% year-over-year until reaching $20M gross.

Congratulations! You've spent 10 years building a sustainable business that now generates $20M per year, probably provides 300 to 400 jobs, and changes the lives of thousands. Is this what you've been inspired to achieve?

Budgeting

Accurate financial planning leads to precise calculations of spending per category, enabling effective budgeting.

In the agency business, fixed costs, such as salaries, tool costs, marketing and sales expenses, and overhead, are always present. However, there are also variable costs like expanding headcount, R&D, corporate retreats, hardware upgrades, or seed investments in promising startups, etc. These, along with any discounts, special offers, or underpayments, can be measured and budgeted in advance.

Depending on key metrics like new sales, retention revenue, or churn, you can then plan future spending. Essentially, budgeting helps answer three crucial questions:

Ensuring that spending does not exceed the available or budgeted funds.

Planning for future allocations (like future hires or other expenses).

Assessing if it's possible to deliver more value to clients with the same or better quality but at a lower cost.

At Belkins, our main budgeting categories include:

Marketing:

Paid channels (such as paid ads, SEO, link building, content, and review platforms like Clutch).

Current salaries and future raises.

The number of new leads generated and the cost per lead.

Future hiring, expansions, new initiatives, and R&D.

This helps our CMO determine how much can be spent on the expected number of leads and plan long-term initiatives.

Achieving precision in our financials took almost a year, including categorizing expenses related to all marketing tools, website development team, CRMs, website design, and anything lead-generation-related under marketing. Though there are some shared tools or resources, we managed to get it down to a single license for accurate numbers.

Sales:

The ratio between the cost of new sales and actual top-line sales revenue.

Customer Acquisition Cost (CAC).

Budgeting in sales involves determining the percentage of revenue that can be allocated depending on whether the sales team underperforms, performs, or overperforms.

COS (Cost of Service):

SDR (Sales Development Representative) budget.

AM (Account Manager) budget.

Copywriting budget.

Lead Generation budget.

Design budget.

Development budget.

Tools (like engagement platforms, lead generation tools, client domains, G Suites, etc).

This is whatever you spend on servicing your clients.

After a few quarters of collaborative budgeting between your team and the finance department, this becomes one of the best exercises for decentralizing operations. Every manager plans their spending accordingly, purchasing tools, promoting people, giving raises or demotions, with a clear understanding and reassurance that everything is well-managed.

We utilize Ramp.com to issue dedicated cards for each manager, assigning specific budgets and enabling approval notifications. This approach proves highly effective in scenarios where direct responsibility for spending needs to be assigned to your team.

Another great initiative that works well with budgeting is planning for future hiring. With growth, you quickly realize the need for experienced, ready-to-deliver hires. However, it can take 30-60 days or more to close a hire, plus another three months to fully ramp up a new employee. If you're anticipating an increase in sales for Q2 and things are progressing as planned, your delivery team needs to start hiring now to ensure they have trained personnel ready. With budgeting and open high-level numbers, everyone can see, for example, "Okay, assuming the sales team will deliver $100K in new revenue in March, I need +5 SDRs, which I should budget for in January to recruit and then train." This allows the recruitment team to measure their capacity accurately, and so on and so forth.

It took us two years to adopt financial planning, plus an additional year to integrate budgeting and get everyone on board. Now, stepping into 2024, each manager, whether in sales, marketing, SDR, recruitment, or development, has planned their spending for the entire year based on the company's KPIs we introduced to them.

A few important points on planning and budgeting:

Always budget more than you think you'll spend, as you will likely end up spending more.

Allow your team the possibility to exceed the budget if needed, with your approval. Alternatively, confirm if they absolutely cannot exceed it in any scenario.

The budgeting percentage shouldn't be flat and should decrease as your company grows. For example, if you spent 5% on key delivery like copywriting at $50K MRR, then at $75K MRR, this number should reduce to 4.5% or less. With growth, the saved 0.5% budget can be allocated to other business functions like HR, admin, or benefits, as their spending isn't linear.

Don't just review the overall budgeting retrospectively. Even if high-level figures look good, they don't provide the full picture. Dive deeper every three months.

Encourage your managers to submit their own budgets rather than doing it for them.

This is my personal approach to financial planning and budgeting. I’ve shared how I did it, but keep in mind, I don’t have a formal financial background. This method is what I figured out over my 7 years running Belkins. We’ve never had issues with overspending or unclear scaling directions.

Fast forward to 2024, my team has already submitted their planning and budget, which we already approved in a board meeting at the end of December.

Now, we have a clear understanding of the basic scenario (our plan), a negative scenario (in case the market crashes in 2024), and a positive scenario (if things pick up quickly). We spent time from mid-November to the end of December finalizing this, with everyone taking responsibility for their part.

This exercise allows me to remain confident about the future and offers a sneak peek of what might come next under basic, negative, or positive scenarios.

We also have a plan for a very negative scenario, but that's life – in such cases, I'm prepared to accept whatever comes.

Share this #11 edition on LinkedIn and tag me, and I'll share my exclusive financial planning template – the very one you glimpsed in the images attached to this newsletter. It's a practical tool to aid in your own financial planning journey.