#4 Delving into Engagement Models

This edition unravels the intricacies of different engagement models, shedding light on their operational and financial implications through the lens of real-world experiences.

Catch up on ‘Newsletter #3: Agency 101: Types and Fundamentals* if you missed the previous edition.

The topic of engagement models for agencies is close to my heart.

It’s something I've mulled over quite a bit, and I'm quite thrilled about Belkins’ choice of the fixed monthly subscription business model.

Let me share why in today's discussion.

In my journey, I've come across a variety of engagement models, each with its own set of merits. Here they are:

Project-based: You earn upon the completion of a designated project.

Retainer-based: A steady monthly fee for the services you provide, similar to a salary.

Commission-based: Your pay is tied to achieving certain specified results.

Pay-per-hour / Per-deliverable: You bill based on the hours spent or per specified deliverable.

Hybrid/Blended: A concoction of 2-3 engagement models depending on the phase of your agency or client relationship.

Let’s break them down:

The last few times when I sit down to write this newsletter, it seems that each time writing takes me into writing long-reads rather than a quick summary of insights.

It got me thinking: how do these longer reads sit with you? Would you prefer shorter insights or is this depth of discussion working well?

Feel free to share your thoughts in the comments.

1. Project-based:

This model is a gem when it comes to profit margins – they are the highest here.

The beauty lies in the added value you bring to the table, allowing you to command the price. The costs for the same service could range from low-ACV (i.e., $10K) to high-ACV (i.e., $500K), influenced largely by your client's profile and the prowess of your sales team in sealing deals.

Although the margins are nice, on the flip side, the sales process can be quite a maze.

Crafting a scope of work (SOW), that's tailored to each client is a go-to strategy when selling project-based, which often means 3-5 meetings to get it right, especially if your clients require a bit more guidance.

This prolongs the sales cycle, with sales executives (SEs) investing a lot of time in developing the SOW rather than engaging new prospects.

Agencies operating on this model often rely heavily on word-of-mouth referrals, although there's a growing interest in scaling through advertising and outbound initiatives as in current market conditions, word-of-mouth is not enough anymore.

Here’s a real-world scenario:

We were approached by a leading video agency in the United States known for shooting ads for big brands like Adidas, Nike, and Tesla. They want to engage with agencies like Belkins to boost their lead generation and attract new clientele. However, the nuances of selling to outbound leads posed a challenge initially, since they used to close only referrals. Unexperience with closing outbound deals often leads to a negative ROI in the first few months. It's a learning curve; some adjust their processes, others who don’t want to adapt, give up, and stick to stable, more profitable, and less aggressive approaches.

The bottom line is scaling project-based work from an acquisition standpoint takes time and resources, so be ready to invest.

Additionally, there's the aspect of payment terms and ensuring a steady revenue stream.

For instance, if you’re a marketing agency building a Go-To-Market (GTM) strategy for a client at a cost of $100K over six months, once the project concludes, the revenue stream dries up. Retaining such clients for longer time, let’s say from 1 to 5 years becomes new challenge and you need to retain them for a longer time to recuperate the cost of acquisition of such clients.

Some agencies have cracked this code, but if you solely operate on a project-based model, the absence of recurring fees can be unsettling as you scale.

I've used an example of a marketing agency here, since I am more familiar with the space, but if you explore Clutch.co, you’ll find a plethora of agencies in Software Development, HR & Recruitment, Finance & Legal, Coaching, Management Consulting, and Architecture, many operating on a project-based basis.

It’s a solid model, yet, I am confident that they all face similar hurdles:

1. Lack of predictability for scaling.

2. Difficulty in driving new sales beyond word-of-mouth referrals.

3. The desire to establish a retention model to ensure a steady revenue stream from clients.

2. Retainer-based

Ah, the model I'm intimately familiar with.

It’s the bedrock upon which Belkins was built, resembling the classic SaaS (Software as a Service) model with its predictable revenue streams.

This model has been a boon for us, morphing our services into a neatly packaged offering and paving the way for straightforward financial planning.

You get a recurring fee every month for a set roster of services you provide. Here is a quick explanation for those who are not familiar with this model:

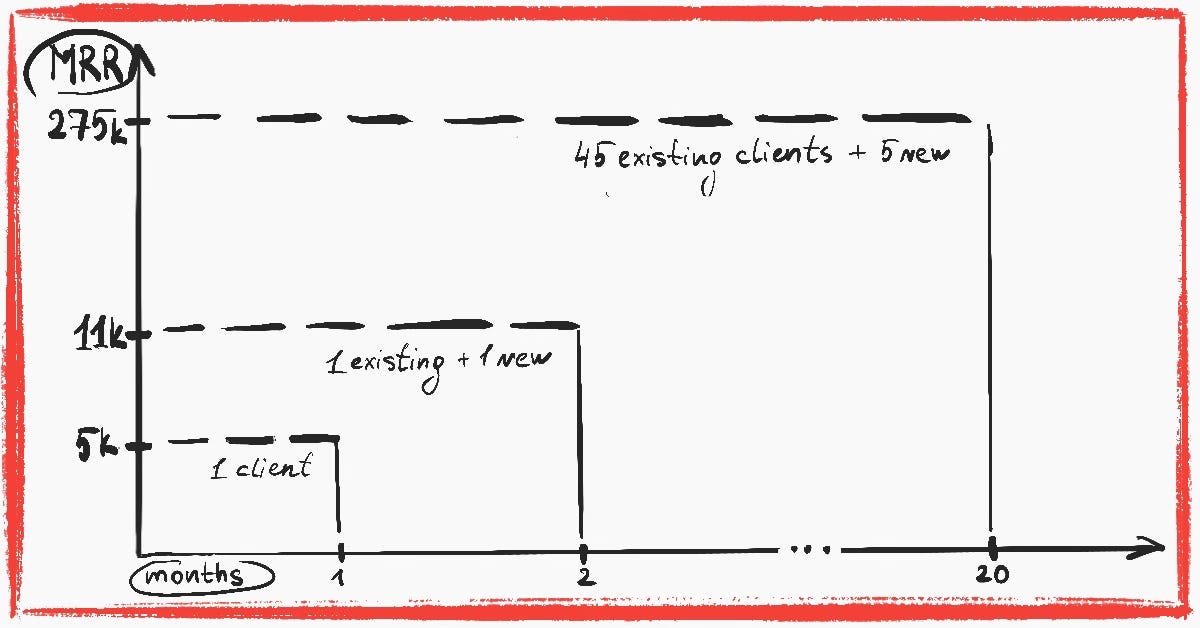

Month One: 1 client pays $5,500 / Monthly Recurring Revenue (MRR) is $5,500

Month Two: 1 existing client + 1 new client pays $5,500 each / MRR $11,000

...and it continues until...

Month Twenty: 45 existing clients + 5 new clients pay $5,500 each / MRR $275K

Now, the tricky part is when it comes to retaining these ongoing clients, especially as the numbers climb to, say, 50.

It demands a hefty operational lift, dealing with new client onboarding, ongoing relationships, churn, unmet expectations, and delayed payments. Every client brings a unique set of needs and expectations to the table, and if operations, communication, and multitasking aren't your forte, you might find yourself in hot water.

I've witnessed agencies excel at delivering projects but stumble in managing client relations, turning the process into a less enjoyable experience despite fruitful results. If this rings true for you, navigating the retainer model could be tricky as here, the client's journey often holds more weight than the final deliverable.

An essential nugget I always share with my team is the importance of understanding what a ‘result’ means to each client.

It's crucial to ask, as what we might deem significant may not align with the client’s expectations. Sometimes, for Belkins’ clients, it's not about the number of appointments set, but about testing waters, spending a budget, gathering market insights, or gaining visibility.

On the brighter side, this model ushers in a solid sense of predictability.

With a retainer fee, you can forecast certain financial metrics with a fair degree of accuracy.

For instance, if you aim for a 10% margin, every $100K in retainers would translate to a net of $10K. This predictability extends to payroll, marketing, sales expenses, churn rate, administrative costs, and overheads. If you nail the unit economics, profitability and scalability are attainable, albeit at a measured pace.

Now, a word of caution.

The service industry is notorious for its high payroll expenses, often hovering around 60-70%, not to mention other overheads, marketing, sales, and perhaps R&D costs. So, your actual profit might not hit the $10K mark even with a $100K MRR and a projected 10% margin.

The margins here are slender, urging a push towards scaling.

If scaling isn’t on your agenda and you’re content with maintaining a comfortable revenue level, say $3M/year or $250K/month, your focus should then shift to tackling churn and new client acquisition.

A churn rate under 5%, a lifetime value (LT) of, let’s say, 12 months, and a cost of sales that's lower than the Lifetime Value (LTV), alongside a steady influx of more than X new clients per month, will set a comfortable pace. But…

The wider the gap between low churn and high new sales, the more promising your success outlook.

Let’s summarize the upsides and downsides of the retainer model:

Advantages:

Boxed offerings simplify the sales process.

Provides a framework for predictable financial planning.

Monthly receivables management puts less pressure on the business (in Belkins’ case, less than 10% of payments are delayed).

Predictable service costs with measurable and anticipatable churn.

Retainer fees enhance client retention as they don’t need to pay hefty sums upfront.

Disadvantages:

Margins are on the lower side.

Scalability could pose challenges if churn and new sales are not balanced.

Managing numerous accounts demands substantial operational effort (imagine juggling 200 ongoing clients).

Growth rate tends to be slower (surpassing 10-15% monthly growth without a dip in quality is impossible).

3. Commission-based

Taking Belkins as a hypothetical scenario for this model, here's how it would play out if we were to embrace it:

Let’s say, I secure 100 appointments for you, and you successfully close 10 deals.

Given that your average deal size sits at $100K, you'd be raking in $1M.

Now, in return for my efforts, you’d hand over a commission of 5% from your total earnings, translating to a neat $50K for my services.

In an ideal world scenario, living off commissions would be the dream. It's similar to earning dividends for executives—get paid only when there's a tangible result to show for.

However, the reality paints a different picture:

Incomplete Control: For Belkins, we only have control over a part of the sales cycle when booking appointments. What if the deals don’t close, despite the promising leads?

Upfront Expenses: With teams to pay and tools to invest in, there’s a significant upfront cost involved. Do I have the liquidity to cover these expenses ahead of time?

Uncertainty Galore: Predictability takes a backseat. An unforeseen event like a pandemic or geopolitical unrest could upend the closing rate. So, if you don't close deals, despite my end of the work being fulfilled, where does that leave me?

I’m curious to know if there are agencies thriving on a commission-only model. If you're one of them, I'm all ears—drop me a message; I'd love to delve into discussions.

I’m aware there are agencies out there who find the commission-only model a comfortable fit, but it was a path I chose not to take for Belkins.

Here's why:

Initial Capital Need: At the outset, we needed funds to build our operations. The commission model didn't lend itself well to this requirement.

Monthly Financial Commitments: Salaries and other recurring expenses necessitated a steady inflow of funds every month, which a commission-based model couldn’t guarantee.

Craving Certainty: The unpredictable nature of commission payouts was a gamble. We yearned for a guaranteed payment structure, unswayed by whether our client could close deals or not.

The commission model, while enticing with its pay-for-performance premise, opens up a can of worms when it comes to financial predictability and upfront investment—elements that were crucial for us, especially in the nascent stages of our venture

But it’s important to add that the appeal of the commission model largely comes from the percentage earnings on every project tackled. It's similar to the reward system in sales, often seen as a lifelong profession.

Reach the top tier, the elite 1% of your sales profession, and you start earning much more than any retainer as a commission of the deal's value.

Agencies operating on a commission-based model, I believe, are enjoying the highest margins.

It's an engagement model full of potential for me, and I see Belkins moving towards it in the near future.

The idea of earning a portion of the financial cake with every successful deal closure is incredibly appealing, offering a level of financial reward that fixed retainer models can hardly match.

4. Pay-Per-Hour / Per-Deliverable

This model is a classic go-to for many outsourcing agencies, freelancers, and professionals like lawyers or accountants. Since the bulk of the work is carried out by one or a few individuals without extra costs involved, the math is straightforward, and both parties grasp the mechanism intuitively.

For instance:

I charge $50/h for my design services. If I work for you for 8 hours a day, you owe me $400/day, and here's what I can deliver.

I charge $250 per landing page. You need two landing pages; your bill is $500.

Simple, elegant, and direct. But then, why is there a shift away from this model, especially among creative agencies?

The reasons are threefold:

No Add-on Value: There's no room to stretch the margins. If you pay me $50/hour and I work 8 hours a day for you, it's akin to a job with a daily wage.

No Scope for Earnings Progression: The earnings are tethered to the hours I put in. There's a cap on how much I can earn as there are only so many hours in a day. This model doesn’t allow for an exponential increase in earnings.

Scaling Dilemma: As you scale up the client base, the need for manpower scales up proportionally. This is a typical outsourcing hiccup that I delved into in Newsletter #3 (check it out if you have missed it).

Today, I had a conversation with a product design agency whose business model is a fixed $6K/month for design work comprising 20 story points per month with 2-week sprint cycles. They had the option to charge per hour or per deliverable, yet they opted for a fixed monthly cost. Why? Revisit point #2 under the fixed model section to understand the rationale.

This model, while straightforward, doesn't foster value add-ons or earnings growth, and, moreover, presents a scaling challenge—factors that have been nudging creative agencies to explore other billing models.

5. Hybrid/Blended

Ah, the hybrid model!

It holds a certain allure, doesn't it?

If sticking to one model seems too limiting or uncomfortable, why not blend two or three?

It offers a way to diversify your earnings and mitigate the downsides associated with each individual model.

Here’s are a few examples:

- Fixed Monthly Subscription + Commission: Taking Belkins as an example, you could pay us a fixed fee of $5,500 plus a 2% commission on all deals we secure for you.

- Project-based + Commission: We could build an app for you for $100K, and then take a 1% cut of your turnover for the next two years.

The permutations can go on, although, to be precise, there are 120 possible combinations.

Now, some of you might be thinking, "Why not set up a hybrid model from the get-go?"

Well, through this newsletter and the whole ‘From Zero To Agency Hero’ project, we aim to outline a blueprint for building a robust, streamlined operation.

And here’s a word of caution regarding the hybrid model:

Operationally, blended offers can be a nightmare. Imagine managing 50 clients, each with different fee structures, payment terms, and engagement models.

Your task isn’t just to drive new sales and mitigate churn but to juggle the administrative intricacies each model brings.

Veterans among you would acknowledge that each engagement model demands a unique management approach. For instance, handling churn in a fixed monthly subscription model differs significantly from a project-based or pay-per-hour model

A hybrid model makes sense only after you scale to a point where you've got a solid operation, and then introducing a new service with a different engagement model is easy.

By then, you have tight processes, a seasoned delivery team, and maybe even a different sales team to handle the new service, each with its own set of KPIs and metrics.

However, when you're in the early stages of nurturing your first 20 clients, steer clear of the hybrid model. Focus on mastering one model, make it work for your advantage, or refine it as needed.

Much like the gradual evolution of agency types discussed in Newsletter #3 (consulting, building, outsourcing, remember?), evolving your agency's business model methodically is a prudent approach. A possible trajectory could be:

Pay-per → Fixed-cost → Project-based → Commission-only / Hybrid.

This phased approach lets you navigate through the intricacies, learn from each model, and progressively build a more complex, yet manageable, operational framework.

If you’ve read up to this point and don’t feel overwhelmed, and you haven’t yet connected with me on LinkedIn, please do that today.

Also, don’t forget to share, comment, like, or show any signs of engagement. Your support fuels my passion for sharing these insights.

Thank you for your time, and see you in the next edition!

I knew all this economics and still it was a pleasant and enjoyable read! Thank you so much! I love that you've put hybrid model on the map