#8: Sustainable Growth

Diving deep into key metrics like CAC, LT, LTV, Retention, and Churn, complete with benchmarks and indicators of positive and negative trends.

When you start an agency, client delivery is the most important focus for you. How well you deliver the service will determine your agency's growth. Client retention and LT or LTV (lifetime or lifetime value) are key indicators of your agency's success.

The benchmarks are:

Client churn rate:

Less than 5-10% - good

Less than 10-15% - you are okay

More than 20% - things are not working well

Lifetime:

More than 12 months - good

Between 6-10 months - you are okay

Less than 3-4 months - things are not working well

LTV can vary, but for a sustainable model, especially for marketing agencies, your benchmarks for 12-months LTV should be:

Less than $15,000 - things are not working well

Between $25,000-$50,000 - you are okay

More than $75,000-$100,000 - good

You might be at any of these levels, but ideally, you want to be in the "good" section. Why?

Because of CAC (Customer Acquisition Cost).

As you move from having 10-20-30 ongoing clients, CAC vs. LTV becomes your focus. Let me explain further:

Existing clients are churning, and you need to replace them with new ones thus new sales is important to keep afloat.

You don’t want to keep people on the bench. Effective agencies operate when people are 90% to 110% busy:

At 90% capacity - people are re-charging.

At 110% capacity - the agency is growing.

New clients are great for upselling and cross-selling, keeping the pipeline healthy.

You might be changing service offerings or prices.

You want to grow and scale.

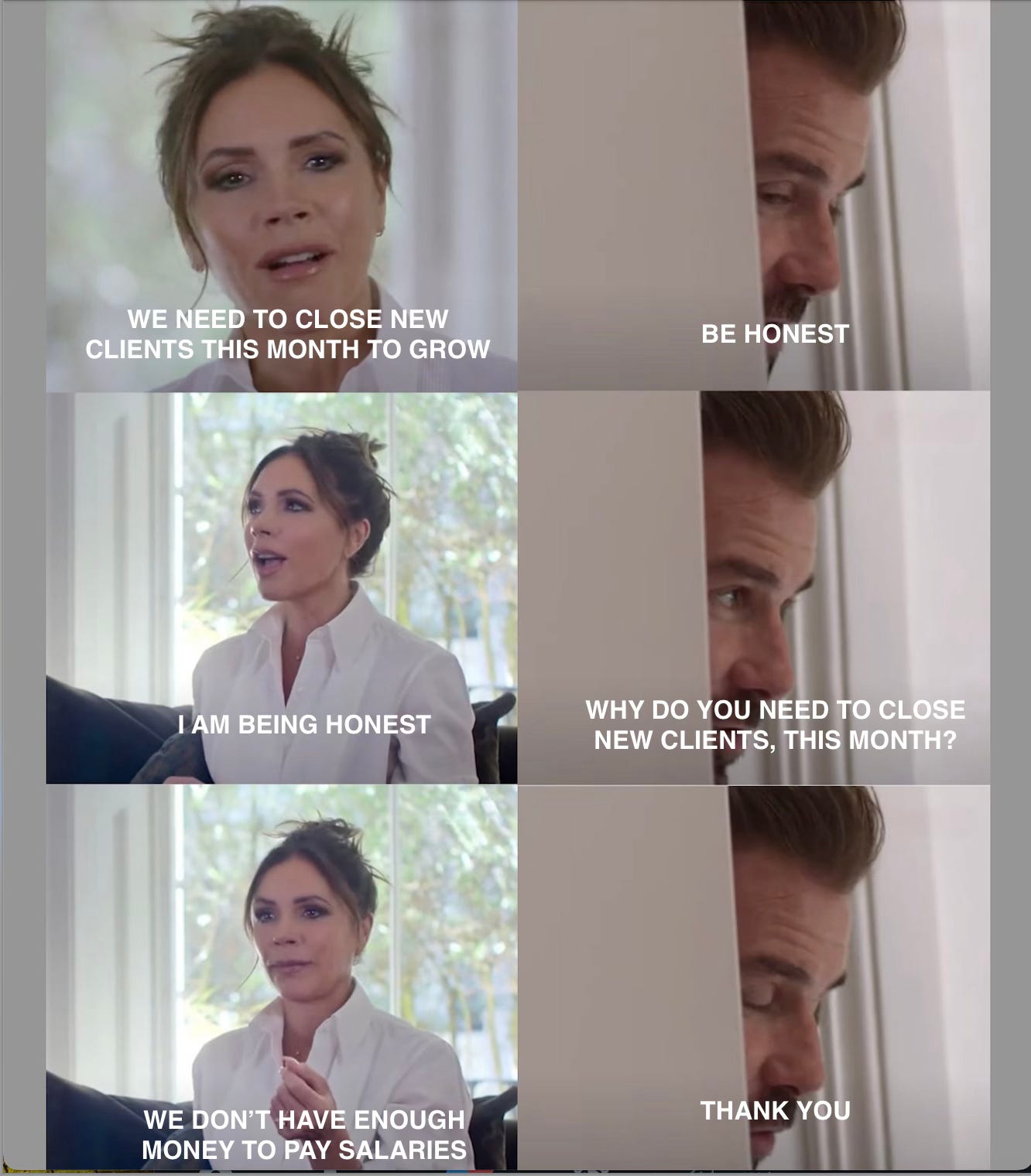

There's another sad truth, and the beaten-path agency owners should know it: sometimes new sales is important, simply because you need new cash injection to pay salaries. This meme of David Beckham says it best

Benchmark for CAC/LTV in service business:

Less than 5% of LTV - good

Less than 10% of LTV - you are okay

More than 15%-20% of LTV - things are not looking good

The math is simple: LTV should be as high as possible, and CAC should be as low as possible. The difference between these two is your profit.

Now, the reality of CAC in 2023 for agencies is as follows:

Average cost per new opportunity across all channels: $400

My top-5 channels:

Outbound - $250/per new opportunity

Paid Ads - $350/per new opportunity

Referral - $450/per new opportunity

Organic SEO - $300/per new opportunity

Direct - $500/per new opportunity

Average sales closing rates:

More than 10% - good

More than 7% - you are okay

Less than 5% - things are not looking good

Important to keep in mind:

Every marketing channel has a ceiling in terms of scalability and cost. Investing beyond this limit is futile as you've already reached the maximum efficiency.

For instance, last month we maxed out on all relevant keywords in paid ads and generated 100 new opportunities. Investing more at this point would be financially unwise, as the cost per deal would double, and the volume of additional opportunities would be marginal.

Sales closing in 2023 was one of the worst in 7 years, and 2024 is shaping up to be similar. Stay resilient.

Seasonality still affects sales. In our experience, March, July, and December are typically slow months.

However, what constitutes a low season for some may be a peak for others. I've shared some insights on this topic on LinkedIn, here it is

Seven Things to Know about Sustainable Growth:

Lifetime Value (LTV) is the most important metric for your agency as it's where you make money. It's very challenging to reduce Customer Acquisition Cost (CAC) because the cost of B2B selling is high in the agency business due to factors like:

long sales cycles (up to 60 days and more)

Sales Executives requiring up to 3 months to ramp up

one need up to 50 new opportunities per month per Sales Executive to achieve decent results (do the math 50/new opportunities X $400 = $20,000/marketing budget)

high costs for tools and overhead

If reducing CAC is difficult, focus on building better client relationships to boost retention and LTV.

Sales teams naturally push for new revenue, often at the expense of LTV. Allowing sales teams to close deals not aligned with your LTV and churn rate can lead to acquiring clients who don't fit your Ideal Client Profile (ICP), resulting in high churn and low LTV. To address this:

Implement a deal qualification process. Business Development Representatives (BDRs) should filter out deals that don't meet specific criteria, such as industry, size, and success rate. Check out my related post here.

Develop a process where sales teams create a success plan for each client, offering results estimates and a roadmap to achieve desired outcomes. This approach discourages overpromising by requiring a logical explanation of the process.

Align your sales and delivery teams. Regular meetings and transparent communication about client results encourage a collaborative approach and shared celebration of successes.

These three strategies are fundamental, yet surprisingly, not many agencies implement them.

Adhere strictly to your deliverables and standards. Avoid letting your sales or delivery teams offer discounts, high commitments, exceptions, or extra services to new or existing relationships unless it's absolutely necessary due to poor KPIs.

It's critical because many team members might not realize how narrow the profit margins are. For instance, if you're operating at a 10%-20% margin, offering a 10% discount on a $5,500 monthly retainer wipes out all your profits. While this might seem okay for clients who get results and team members who get paid, it's detrimental to you as you end up earning nothing for that month’s service.

Don’t extend 2023 prices to ongoing clients into 2024, if the increase in fees is required for your financial health.

Let me explain. Contract timelines are meant for reassessment and change, usually on an annual basis. If you need to increase prices, it's often challenging for the client success team to renegotiate contracts with clients, especially if proposing a significant hike like 20%. Price increases might be necessary due to various factors such as:

increased seniority of specialists who need to get paid more

high Customer Acquisition Costs (CAC)

rising tech costs

adjustments to make the unit economy viable

Ensure your delivery team is proactive in renegotiating contracts in a timely manner.

Leverage upselling and cross-selling to extend customer lifetime value (LTV) and increase profit margins while keeping Customer Acquisition Costs (CAC) lower. Typically, upselling costs are about 50% less than acquiring new customers.

Terminating non-productive relationships is a necessary aspect of running an agency. While agencies are all about people serving people, not every client brought in by the sales team will align with your delivery approach. It's better to end such partnerships early rather than risk the stability of your agency due to poor early-stage decisions.

This year, we experimented for a month, allowing our delivery team to churn up to 12% of clients compared to the usual 10% KPI. This additional 2% comprised engagements not in sync with Belkins' direction as of December 2023.

Aim for controlled growth, ideally not exceeding a 25% month-over-month increase. Occasional spikes are manageable, but consistent overgrowth can lead to a decline in service quality, which is detrimental in the long term. Sustainable growth should be your focus, allowing ample time for your team to ramp up, gain experience, and effectively serve your clients. Rapid expansion, like a 300% yearly growth rate, can lead to burnout. A steadier growth rate of 50-100% per year is preferable.

Think of your client portfolio as akin to your personal health. Just as making smart decisions early on about diet, exercise, and stress management can contribute to long-term health, being disciplined with fees, sticking to your ideal client profile (ICP), and maintaining contract integrity can lead to smoother, more sustainable growth for your agency.

Very cool - I haven't seen many places lay out the numbers so transparently. Something we're trying to do.

Some of our clients don't pay every month. It's just the nature of the business. Sometimes they maybe skip a month or two and then come back. Not sure how to think about this with churn. Any suggestions? Should we just come up with a rule and stick with it (Churn would be a customer who hasn't paid us in the last 60 days), type of thing?

You list "Outbound" and "Direct" as separate channels. What's difference?